Most charities live month-to-month. A good campaign can keep the lights on; a missed target puts everything at risk. It’s exhausting. And it’s not sustainable.

But it doesn’t have to be this way.

Across the Muslim world—and increasingly in UK charity spaces—there’s a growing conversation about awqaf (Islamic endowments) and other long-term funding models. These aren’t just ancient concepts. They’re time-tested financial strategies that build independence, resilience, and dignity into charitable work.

I’ve spent the last few years advising charities on endowment strategies—how to structure them legally, align them with Islamic principles, and make them work for real impact. It’s not a quick win. But it is a game-changer.

A well-governed waqf or endowment gives a charity:

- Financial stability – predictable income year after year

-Donor confidence – people give differently when it’s about legacy, not just urgency

- Freedom – less dependence on grant cycles or high-pressure appeals

Vision – leaders can plan 5, 10, 20 years ahead

But there are barriers too.

- Many boards don’t understand the model.

- Some fear the legal complexity.

- Others simply don’t believe it’s possible to raise capital for anything that doesn’t feel immediate.

And let’s be honest—there are still too few advisors and institutions in the UK that know how to build awqaf well.

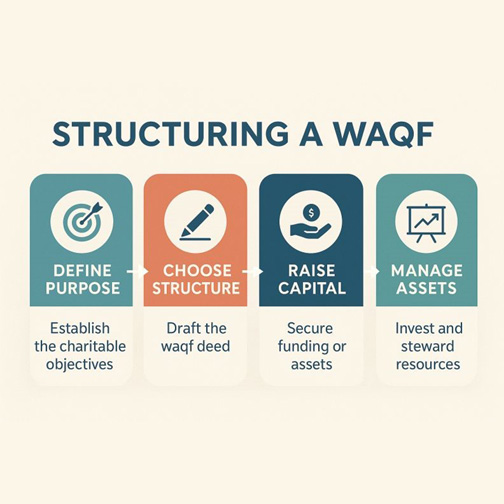

That’s changing. Quietly, Muslim charities are beginning to invest in total return approaches, draft proper waqf deeds, and structure governance that balances sharia with Charity Commission compliance.

This is how we future-proof our impact.

It’s not flashy. It’s not quick. But it’s how we build institutions that last beyond our own lifetimes.

Is your charity exploring endowments or waqf? What questions or hesitations have you faced? Or are you already seeing the benefits?

Beyond the Fundraising Cycle: Awqaf, Endowments & Sustainable Giving

Date: 2025-10-13 | Author: Admin

← Back to Insights