For many Muslim charities, the struggle to move funds across borders isn’t just logistical — it’s existential. Debanking, compliance restrictions, and delays in traditional banking systems can stall humanitarian relief, damage trust, and block essential work.

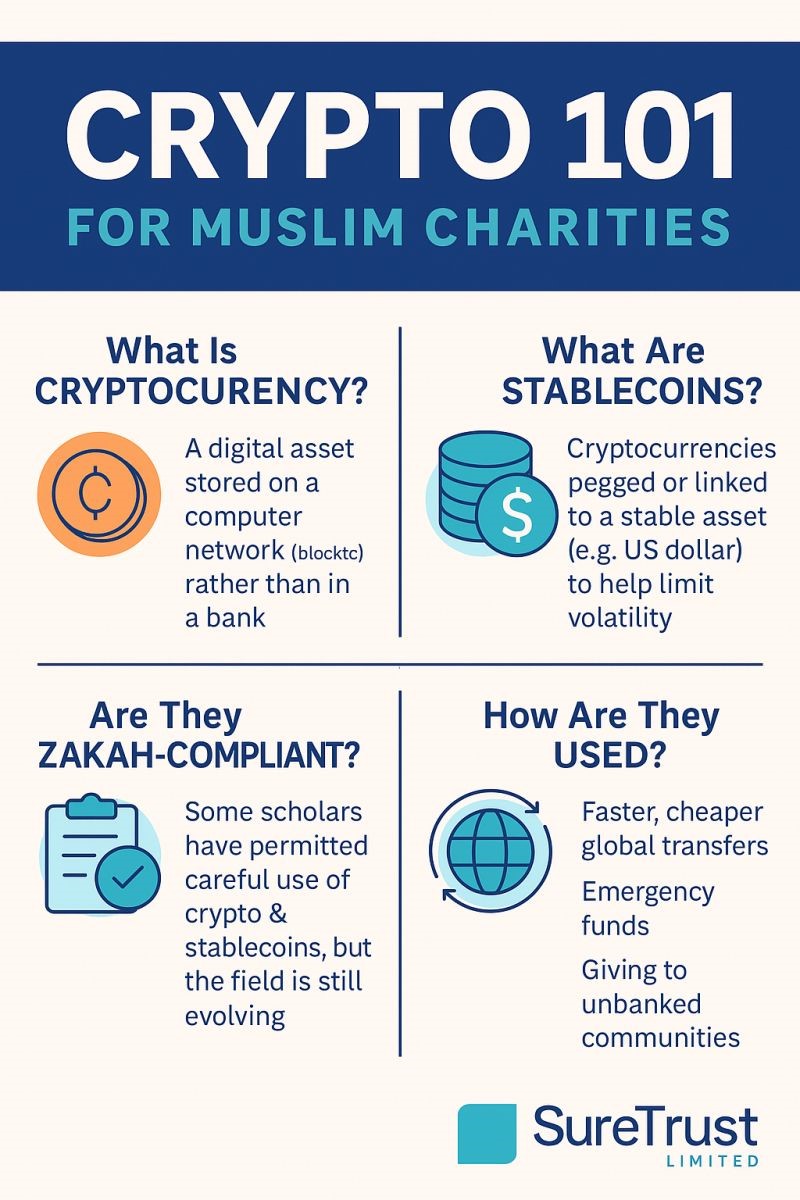

But while these problems are growing, an alternative is quietly taking shape: digital currencies — particularly stablecoins like USDC and USDT, which are pegged to real-world currencies and can be transferred globally in minutes.

So the question is no longer “what is crypto?” — but rather: Can Muslim charities use it? Should they? And how?

🚧 The Risks:

Let’s not be naïve. The crypto world is full of hype, speculation, and volatility. Many charities (wisely) see it as risky and unregulated. But that’s only part of the picture.

- Bitcoin ≠ Stablecoins – Bitcoin fluctuates wildly. Stablecoins like USDC don’t (or shouldn’t).

- Smart contracts ≠ gambling – There are halal structures being explored globally for Zakat and Sadaqah.

- Donor confidence – Many funders still see crypto as a red flag, not an innovation.

✅ The Opportunities:

Used wisely, digital currencies could be part of a future-proof financial strategy for charities, especially those facing banking exclusion.

- Faster, cheaper cross-border transfers – Especially to partners in fragile or sanctioned regions

- Transparent audit trails – Every transaction recorded on-chain

- De-risked models for humanitarian response – Crypto wallets can act as emergency liquidity reserves

- New donor engagement – A younger generation of Muslim donors are already in the crypto space

🧠 But What About Shariah Compliance?

This is the big one. Is crypto halal? The answer: it depends.

Many scholars have given conditional approvals based on asset-backing, usage, and transparency. Some fintech innovators are already launching Shariah-compliant stablecoins, and others are building endowment models powered by smart contracts.

But most charities haven’t caught up yet. And very few boards have had proper guidance on the topic.

💬 Where We Go From Here

Muslim charities don’t need to go all in. But we do need to:

- Understand the technology and terminology

- Develop internal policies that address digital asset use

- Consult with credible ulema, not just tech marketers

- Consider pilots in high-risk geographies where crypto might offer safer, faster delivery

Have you explored crypto in your charity? What’s holding you back—regulation, risk, perception?

Let’s start a real conversation. The financial future is being built — with or without us.

Can Muslim Charities Embrace Digital Currencies?

Date: 2025-10-04 | Author: Admin

← Back to Insights